SINGAPORE (15 April 2021) – Shariah-compliant shares are shares of companies whose operations abide by the requirements and guidelines of Islamic Law. It is permissible for Muslim investors to invest in shares of these companies.

To be Shariah-compliant, companies must meet two criteria:

- They operate in permissible business sectors;

- They meet a set of financial parameters set by Shariah scholars.

The following are non-permissible business sectors a company must not operate in to be Shariah-compliant, according to scholars with the Auditing and Accounting Organization of Islamic Financial Institutions, or AAOIFI.

- Alcohol

- Adult Entertainment

- Cinema

- Conventional Banking & Finance

- Conventional Insurance

- Gambling & Gaming

- Gold & Silver Hedging

- Pork

- Music

- Weapons & Defense

- Interest-bearing investment activities

A company operating in a permissible business sector must also meet a list of financial parameters before it could be classified as Shariah-compliant.

Below is AAOIFI’s set of parameters that a company must meet to be certified as Shariah-compliant by the institution. These underwent revision in 2020.

Financial Ratios – AAOIFI’s Criteria

- Total sum of non-permissible income must not be more than 5% of total income generated by the company;

- Total sum of interest-bearing investments, both short and long term, must not be more than 30% of the average 12 months of market-capitalisation of the company;

- Total sum of interest-bearing debts must not be more than 30% of the company’s average 12 months market capitalisation of the company;

- A company must not have investments in fixed income (bonds) or have preference shares.

DIFFERENT SHARIAH RULINGS

Different Shariah scholars may have slightly different rules.

For eg., the team of scholars behind the Dow Jones Islamic Market Index have slightly different criteria of what constitutes compliance. Therefore, a company certified as Shariah-compliant by the Dow Jones scholars, may not meet the standards set by scholars at AAOIFI, and vice versa.

Similarly, scholars with Malaysia’s Securities Commission have slightly different criteria on what constitutes Shariah-compliance. A Shariah-compliant company listed on Bursa Malaysia may not be compliant when put through AAOIFI’s screening.

The differences in Shariah rulings, however, are understandable as there are 1.8 billion Muslims living all over the world under different conditions. However, the good news is that these rules are converging.

At this point in time, however, AAOIFI’s standards are the more widely recognised and accepted by global Islamic financial institutions.

SCREENING FOR SHARIAH COMPLIANCE

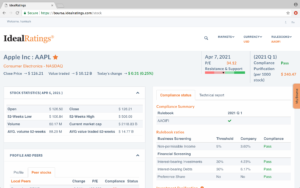

Below is an example of how a company is screened for its Shariah-compliance, using a web-based screening solution BOURSA, a product developed by California-based IdealRatings, Inc. BOURSA uses the AAOIFI rulebook to screen companies.

APPLE INC. (As at 7th April 2021)

Source: BOURSA https://boursa.idealratings.com

Apple Inc., listed on Nasdaq is Shariah-compliant, according to AAOIFI’s ruling.

When put through the financial screening, 3.6% of Apple’s income came from non-permissible sources. As it’s allowed to have up to 5% non-permissible income, Apple passed the income test.

Similarly, Apple had 4.23% of interest-bearing investments, below the 30% threshold and 6.17% interest-bearing debts below the 30% allowable holding. The company does not have preference shares.

Since Apple met all the financial rules as at 7th April 2021, it is a Shariah-compliant company.

INCOME PURIFICATION

What to do with Apple’s non-permissible income?

Source: IdealRatings’ BOURSA.

An investor who holds Apple’s shares is required to cleanse that income or what we call income purification, at every quarter.

In this example, for every 1000 stocks that an investor holds he would need to give away USD 240.47 as sadaqah if he holds 1000 shares of Apple in Q1 2021. (See diagram)

ZAKAT ON SHARES

Income purification is not zakat. It is obligatory upon a Muslim to pay zakat on shares once his holdings reach its haul and nisab. You can look up the Islamic Council of Singapore’s Zakat.sg should you need more information on zakat on shares.

More info on IdealRatings screening solution, BOURSA, is available here: www.halaluniverse.net/BOURSA.-/-