Singapore (5 January 2021) – Today, we live in a world where it is increasingly challenging to reconcile the ever rising values of financial assets amidst a backdrop of deteriorating global economy.

Years of money printing and artificially low interest rates, coupled now with massive post-COVID19 fiscal spending are keeping so-called risky assets buoyed, despite seemingly lofty valuations and an economic backdrop that suggests otherwise.

One just has to look under the hood of all the economic actors – households, corporations and even governments – to see that there is a marked financial deterioration in their respective balance sheets when compared with just a year ago. In normal years, this would have been a clear sign of a recession and a reversal in values of risky assets, but not this time, or at least not for now.

So what does this mean for 2021? We believe that this dichotomy of views is best reconciled by looking at two different time frames: the short- and long-cycles. Evidence suggests the short cycles will likely continue to be in play, especially as central banks surrogate their balance sheets prolonging the party for risky assets, albeit presenting investors with short-term opportunities. We call this “stretching the rubber band (even) further” as we move even further away from “equilibrium”.

Households Net Worth Deviation From GDP Far Larger Than 2000, 2008

This so-called “equilibrium” level of assets is not something that is easy to estimate but we have come across some interesting charts that try to illustrate this. One such chart refers to nominal GDP (which is taken to be the value of the economy) versus the net worth of households (which consist of investment assets such as stocks, bonds, properties minus their corresponding liabilities, if any), which effectively is the balance sheet of households.

As we can see from the chart, there are periods in which the net worth of households deviates from nominal GDP but are then brought back towards “equilibrium” (red arrow) by a recession. This was true in 2000 and again in 2008.

Note that the deviation we see today is far larger than what we saw in 2000 or 2008, suggesting that when the adjustment comes it will be far larger than what we have ever experienced. The present recession is still underway and it’s unclear as to whether and when it could trigger a similar move back to “equilibrium”.

Chart 1

Source: Federal Reserve; FA Wealth Management

Source: Federal Reserve; FA Wealth Management

So the bad news is that, from a longer-term perspective, the party has extended way past midnight (and to be fair, it has been the case for the past few years) and someone could take away the punch bowl at any time. But the question of “when and what” will trigger a reversal in financial markets remains the trillion-dollar question. What is clear is that when it does happen, it will not in any way be an orderly normalisation as the consequences of years of misallocations will all come home to roost.

Punch Bowl Filled To The Brim

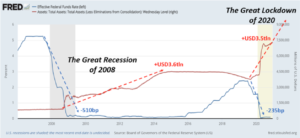

So what’s the good news? Well, not only is the punch bowl still there but governments and central banks have refilled it to the brim thanks to COVID19. What the virus has effectively done is force both these entities to ramp up the printing presses both to support a massive wave of fiscal spending and direct central bank action via quantitative easing, to counter the Great Lockdown of 2020.

Chart 2

Source: Federal Reserve; FA Wealth Management

Source: Federal Reserve; FA Wealth Management

A Repeat of Roaring 20s

This influx of liquidity into an already flooded global system (from the Great Recession of 2008) will only extend the party even further past midnight.

Some commentators are now even suggesting we could see a repeat of the Roaring 20s, which was a decade of unprecedented growth that came after the end of World War 1 and the Spanish Flu, events which necessitated drastic expansionary fiscal and monetary action as the case is today. We are less sanguine but admittedly, see a boost to asset prices in the months ahead nevertheless.

Some of the themes we see playing out over the next few months in a post-COVID19 world are:

- A move away from US equities to Non-US or the Rest of the World, especially regions like Europe and Emerging Markets which have underperformed in recent years. This would be a normalisation play where re-allocation are to bring such markets from undervalued to neutral (rather than overvalued);

- A move from growth stocks like tech and stay home equities to value stocks within each market as asset managers rebalance to take profit while remaining positive on the former;

- A move to add “insurance” in the form of gold and others like bitcoin into portfolios to guard against tail end risks e.g. re-emergence of inflation, systemic risks. In relation to this, mining stocks of these assets are likely to outperform the physical asset itself e.g. gold mining stocks especially juniors, bitcoin mining companies;

- Potential of an upswing in the commodity cycle as the world gradually re-emerges from COVID19 and economic activities normalise;

- A greater emphasis on investments related to providing climate change solutions. Post COVID19, the world will likely be more aware of its vulnerability and is likely to view climate change from a different set of lenses.

In summary, financial assets are likely to experience more upside in the months ahead although investors need to be aware of a change in themes, as some that had worked prior to this may no longer generate as strong a performance as before. But amid this short-term positive outlook, investors must formulate a defensive strategy, as there continues to be a deterioration in major economic matrices like debt-to-GDP, ever increasing central banks’ balance sheets, overvalued financial markets etc all of which suggest that the punch bowl could be taken away at any time. -/-

Disclaimer: Mr Sani Hamid is a Director (Economy & Market Strategy) with financial advisory firm Financial Alliance and a Certified Financial Planner. He contributes to www.halaluniverse.net on a regular basis. The information in this article is for educational purposes only and not to be construed as financial advice. Investors should seek advice from a financial adviser before investing.